History

Home / History

This video is a tribute to Richard H. Waterfield upon his induction into the Greater Fort Wayne Business Hall of Fame on June 1, 1995.

The History of Waterfield Mortgage Company and the Waterfield Group

Written by Richard D. Waterfield

My father, the founder of Waterfield Mortgage Company, embodied the American dream.

With values molded from humble roots, Richard Hobbs Waterfield turned hard work, eternal optimism and an ability to hire talented people into what eventually became a very successful financial enterprise. He related well to almost everyone and readily acknowledged their contributions. He also understood that a home was more than just a house. He was tireless in his efforts to help his customers realize their dreams to own a home.

This is the story of his legacy, a great company that, over 78 years, eventually encompassed 46 offices in 22 states, employing over 2,600 people. It became the largest independent, privately held mortgage company in the country. Its servicing portfolio grew to $21 billion, consisting of almost 175,000 mortgages outstanding. Its sister company, Union Federal Savings Bank of Indianapolis which was acquired in 1984, grew to become the largest thrift institution in Indiana, with $3.7 billion in total assets. My father would be very proud of his legacy. What we became…our values, our beliefs and our assumptions we can trace back to our founder.

So let us take a peek back in history to see how it all began.

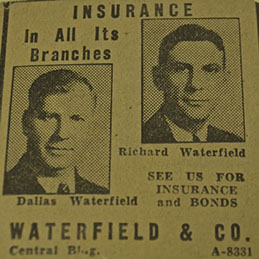

My father’s ancestors trace back to Felicity, Ohio on the banks of the Ohio River east of Cincinnati. His parents and their brood of seven children moved from Fort Mitchell, near Covington, KY to Fort Wayne, Indiana in 1913. He used to joke that they came floating into town on the great flood of 1913, a flood still talked about locally today. He held various sales jobs, including selling securities in Louisville, Kentucky where he met his future lifetime mate, Anne Kendrick McGill. In 1928, he co-founded Waterfield & Co. in Fort Wayne with his brother Dallas, selling insurance for several insurance companies.

1913 flood in Ft. Wayne, IN.

(Photo from The News-Sentinel)

Dad was a star fullback in high school, known as “Flash”. He never graduated, having slept through his final exams because (he said) he always had to get up so early to deliver morning newspapers. Even so, he received a football scholarship to Miami University in Oxford, OH. He later transferred to Indiana University, for reasons never made clear.

"Flash" (center), 1919

The Depression

Having opened for business in Fort Wayne, Indiana only 1 ½ years earlier, the Waterfield brothers endured the stock market crash of October, 1929 and subsequent collapse of the economy. They joined forces with another local insurance agency to survive, and struggled to sell insurance throughout the 1930’s. Insurance was certainly not first on the minds of anyone during those years!

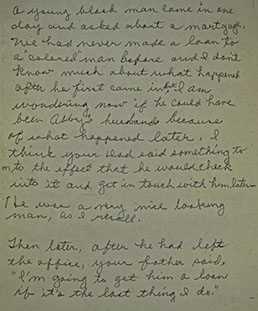

In 1934, Congress passed the Federal Housing Act (FHA), to give a boost to home ownership throughout the country. One of the insurance companies for which the Waterfield brothers sold insurance, Union Central Life of Cincinnati, asked Dad if he would originate FHA loans for Union Central’s investment portfolio. Recognizing that customers seemed to buy insurance through banks that extended them mortgages, he jumped at the chance, and thus began his mortgage banking career.

Whether trying to sell insurance policies, or trying to arrange mortgages, business life was extremely difficult in the ‘30s. Two stories come to mind that he told me which illustrate conditions at that time. When he had a chance to buy his first home in the early ‘30s, he had to borrow the real estate broker’s commission to make the down payment. And in 1935, he had to hock my mother’s wedding ring for a time to raise $500 to satisfy the company’s bank!

He and his brother did survive however, and by 1942 were able to incorporate…with the help of a small loan from their sister. Later on, he often regaled his family with stories of closing a loan on Friday, and then spending Saturdays driving to Cincinnati to get the loan funded so the checks would be good on Monday! Needless to say, he later did not have much sympathy when Saturday working hours became the exception rather than the rule.

Throughout this period, Dad built his reputation for hard work and getting the job done. He fastidiously built his reputation for honesty and reliability with local banks, the lifeblood of any mortgage banker. With strong values absorbed from his upbringing, he became known for his integrity, authenticity, unpretentiousness and concern for those less fortunate. He was a great example for his children, his employees and his friends. Waterfield Mortgage Company later adopted these values as...

“The Waterfield Way”

The ‘50’s; a Time of Transition

The post war building boom led to good times for the housing finance industry. Dad enjoyed some success, but still was mostly running a “one man show”---his brother spending most of his time selling insurance. Dad worked very hard on all aspects of the business, but endured lots of stress. This malady, coupled with his earlier smoking days, probably led to his heart attack in 1955, near his 55th birthday.

Surviving that illness, he resisted the idea of selling his business, and started building a bigger infrastructure in the hopes that I, 11 years old at the time, would eventually want to join the business. (His brother Dallas left the insurance agency in 1959. Dad later reentered the insurance business, eventually hiring Tony King to rebuild the agency.) He started looking for assistance to help him grow his business.

Dad had a very good eye for talent, and over the next few years hired several individuals who helped him expand. (Some eventually started their own companies and became very successful in their own right.) With this additional talent, he was able to buy his first company, the Colfax Mortgage Company of South Bend, IN and moved his right hand man, Vince O’Connor, to South Bend. Vince later led a successful South Bend mortgage company. Entering into this first expansion effort at age 62, while many of his friends were retiring, gave him great pride. It also marked the beginning of many acquisitions over the next couple of decades, fueling the company’s dramatic growth.

Waterfield Mortgage Company and Waterfield Insurance Agency. (1954-59)

The ‘60’s: The Bravick Era Begins

Dad made two important hires in the early ‘60s… Sam Kreigh and Joel Bravick. Sam, a former outstanding high school and college basketball player (at 5’9”!), was an extremely proficient mortgage producer, and his earthiness and common sense mirrored Dad’s temperament and continued the traditions of the Waterfield Way. (Sam later went on to form a very successful mortgage company in Indianapolis.) Joel Bravick was hired in 1960 as the company’s loan closing attorney. He had been a “4 letter” man in high school, a fact which would surprise almost all who knew him in adult life. Joel soon became restless closing loans, and he quickly observed that the driver of our company was single family mortgage production, with legal expertise being ancillary.

Joel Bravick, President Waterfield Mortgage Co. 1966-87

Meanwhile, Dad saw in Joel a man of great common sense with a razor sharp mind and no tolerance for pretense. Those of us who worked with him in later years soon came to recognize that his irascible facade only partially hid a tremendous work ethic, and a 100% commitment to first, the profitability of our company, and second, to its growth and expansion. Upon reaching age 65, Dad began to turn over substantial operational control to Joel, making him President of the company in 1966. That year we opened our second branch in Indianapolis, led by Bill Frey. Joel began to put his mark on the company, taking advantage of the reputation and connections built up by my dad over the previous 40 years.

Joel’s contribution to our company’s growth and success cannot be overstated. He had such a unique way of befriending and motivating people, it is almost impossible to describe. His challenges, his taunts, his insults and his bets somehow helped build a tremendously loyal and motivated workforce. Many, many letters streamed in at his retirement, often stating what a wonderful mentor he had been, and how he had changed their lives.

The ‘70’s: The Big Gamble

In 1973, the company was approached by Lomas & Nettleton, at that time the largest mortgage company in the country, seeking to purchase Waterfield. After a thorough vetting of all our options, Dad and I (having joined the company in 1969) decided to continue to remain independent. Our optimism about our industry and our business model, coupled with our confidence in Mr. Bravick, made us feel that we could continue to be profitable and grow our independent company in the future.

Waterfield Headquarters (1971-76)

This decision proved prescient in 1976. In that year, we were approached by our senior lending bank, hoping that we could help them with a credit concern on their books. Our major regional competitor, Colonial Mortgage Company of Indiana, was experiencing financial trouble, and the bank wanted us to buy them and eliminate the bank’s credit problem. Colonial was twice our size, but had evidently made some questionable decisions along the way. We saw the opportunity available, and worked feverishly throughout the year to get the deal closed. In the end, the Waterfield family had to pledge all of our stock in Waterfield to get the loan necessary to buy Colonial. If we had defaulted on that loan, Dad's 50 year effort to build a business would have been wiped out.

But it did work out, and the transaction nearly tripled our servicing portfolio and gave the company 13 branches in Indiana, Michigan and Ohio. That transaction, plus the later acquisition of Whitcomb and Keller of South Bend, gave us a network of 26 mortgage production offices throughout the Tri-state area. We had hired and retained many very competent mortgage originators, led by Michael Hannigan and Joe Siman in South Bend, and Doug Carnavale in Grand Rapids. Part of Colonial’s problems stemmed from the recession of ’73-’74, caused by the Arab oil embargo and the federal government’s efforts to stem inflation. High interest rates caused much duress in the mortgage business. Interest rates reached record highs in ’79-’81, and very little mortgage business was to be had by anyone, because mortgage payments would be so high few could qualify, even if they wanted to.

Waterfield Mortgage had survived the earlier recession in pretty good shape, and Mr. Bravick led our cost cutting efforts to survive in ’79-’81, especially troublesome given the family exposure due to our “Colonial” loan. Being in the mortgage business was a stressful occupation in those times. “Relationship building” was a key part of the business, whether it was applied at the mortgage origination level, or “buying” commitments of funds to lend from capital market institutions. Most mortgage executives smoked, and heavy drinking was often a key to building relationships. This lifestyle inevitably took its toll, and we were not exempt from its consequences. We endured several tragic deaths, including Sam Kreigh at 44, Jack Norton (CEO of Colonial) at 54, Al Favory (Ft. Wayne branch manager) in his early 50s, and later Joel Bravick at 64. However, these tough times did set the stage for significant opportunities in the 1980s, as we shall see.

The Tumultuous ‘80’s

Dad died in 1980 at the age of 80. He had left voting control of the company to me, with substantial stakes to other members of our family. His legacy to his family and employees was a fiscally-healthy company with a reputation for honesty and integrity. We had built a mortgage servicing portfolio of about $2 billion, having provided home financing for thousands of families throughout Indiana, Michigan and Ohio.

Upon my father’s death, I stepped in as chairman and Joel continued as president. Shortly thereafter, we formed a formal board of directors. My brother-in-law, Howard Chapman, had been our outside counsel for many years, and wisely guided us through many opportunities and inevitable problems. He joined the board, along with Donald Sherman, who had been most impressive as our company’s tax accountant, as a partner with Coopers & Lybrand. Later, I asked Tom West to also join us. Tom had been president of Lincoln Reinsurance Company, a subsidiary of Lincoln National Corp., one of the largest insurance companies in the country. These individuals provided invaluable assistance and advice as we grew through the 1980’s and took on its challenges.

Award from Junior Achievement

Richard Hobbs Waterfield (1900-1980)

With the dawn of the ‘80s and all the difficulties in the economy, opportunities began to present themselves to Waterfield Mortgage. In 1981, we had the chance to bid on the mortgage servicing portfolio of the Graham Mortgage Co. of Southfield, MI. While we were unsuccessful in our bid, we recognized the opportunity to buy their ten origination branches. Closing this deal extended our reach to Colorado, Arizona, Texas and Washington, D.C. We were most fortunate to be able to hire Jack Teegardin, Charles Bell and Roger Housley, who led our mortgage efforts for many years in these new regions. Our timing proved to be most fortunate, as interest rates began to drop dramatically soon after this purchase, allowing us to refinance much of the Graham portfolio on which we had earlier unsuccessfully bid.

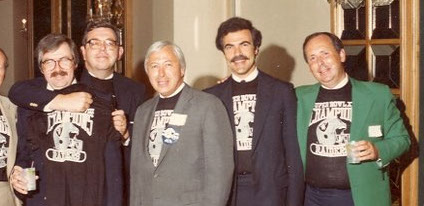

Regional Managers, Happy to be with Waterfield!

The Waterfield Group

As our loan officer cadre became more successful at originating mortgage loans, our warehousing limits at commercial banks were continually challenged. We began to see opportunity in buying a bank or savings & loan association (S&L). We asked the former CFO of an S&L being sold in Fort Wayne, Jerry Von Deylen, to find an appropriate match from the many such institutions being auctioned off by the government agency known as FSLIC. This was occurring due to the ongoing S&L crisis, partially a result of the high interest rates of the late ‘70’s and early ‘80’s, as well as poor regulatory oversight.

Union Federal Savings and Loan Association of Indianapolis (UFB) was perfectly located for us, and we successfully bid on that institution. The family’s acquisition of Union Federal in 1984 expanded our resources considerably, as we folded our origination platform under Union Federal, and renamed it Waterfield Financial Corp.(WFC). We were thus able to largely eliminate our need for warehousing banks by utilizing the warehousing capability of Union Federal. Under the guidance of Mr. VonDeylen, Union Federal grew from $310 million in total assets to become the largest thrift in Indiana. We later successfully bid on three other S&Ls before the government halted the auction process in 1988.

Based on our growing businesses, now consisting of our mortgage servicing plant, our mortgage production entity, our S&Ls, and our insurance agency, we labeled ourselves “The Waterfield Group”, which lasted until our sale in 2006 as described below.

1987 was not kind to our business model. It was not the stock market crash in October of that year that we remember, but rather the “bond crash’ in March of that year that caused a great deal of harm to our financial strength. Very rapidly rising interest rates had caught us “uncovered” and indirectly led to the retirement of our long time President Joel Bravick. His health suffered rapidly after he left the company, very sad to those who had learned so much from him.

Once we recovered from this bond crash, we had to deal with FIRREA, a law passed by Congress in 1989 to deal with the nationwide problems of the S&L crisis. We had purchased a total of four S&Ls with the assistance of phantom, or “regulatory” capital. This capital was authorized by the government to help prop up failing thrifts, necessary to make them palatable to bidders nationwide. However, due to the widely publicized excesses in the S&L industry, largely due to lack of proper regulation, Congress decided that this regulatory capital should no longer count toward capital in any thrifts. The direct effect was that we were given 18 months to replace capital we had counted on in our bids. We strongly protested to our regulators and legislators that the government could not and should not renege on our contractual arrangements with them, but to no avail. The regulators gave us 18 months to find substitute capital or our thrift (UFB) and our entire origination platform (WFC) would be taken over by the government. With great difficulty we were successful in arranging other financing; otherwise in all probability we would have lost our entire franchise.

After Joel Bravick retired as president, the board of directors began to look for a new president. In 1989, I offered the position to Donald Sherman, who had been a long standing board member of the company. He had most recently been CEO of Hyponex, a publicly owned manufacturer and distributer of fertilizer and related products (and the successor company to Old Fort Industries of Fort Wayne). The board had great confidence in his ability to lead our companies in the ‘90’s.

The ‘90’s: The Sherman Era

The 1990’s were generally a good time to be in the mortgage business, with the exception of interest rate and regulatory issues in ’95-97. We had several opportunities to sell, and had the opportunity to go public as well. We gave considerable thought to these opportunities, but in each case decided to remain independent. It had proved very difficult for me to consider selling and putting at risk the careers of so many loyal employees, many of whom might find difficult the possibility of finding similar jobs in the area. We also were well known and often complimented for the extremely long tenure of so many of our employees, a fact that made me very proud. “Pulling the trigger” on a sale was anathema to me, given the efforts made by so many people who embraced “The Waterfield Way”.

Don Sherman, President Waterfield Mortgage Co. (1990-2006)

The company was led by the triumvirate of Don Sherman, Jerry Von Deylen and me. Jerry ably led Union Federal, and Don led our various mortgage and insurance businesses. Don recognized that our industry was changing, and he challenged his management team to undertake a re-engineering process that would allow the company to fully utilize available technology. A significant outcome of this process was the computerized application. Our sales force was among the first in the business to utilize notebook computers.

Dick Waterfield and Don Sherman at company event.

n 1999, the Waterfield Group took another major step toward growth and expansion by outsourcing work for other financial institutions. This initiative was made possible by the internal development of new technology in mortgage origination and servicing. The company was the recipient of a Computerworld Smithsonian Award in recognition of its visionary use of information technology in real estate.

In 1999, I announced that the Waterfield family had decided to restructure the company and give significant ownership to certain key managers and an outside investment group. Our family gave up majority control but maintained a significant minority interest. This recapitalization allowed the company to maintain its independence for the foreseeable future. Don Sherman assumed the duties of Chairman of the Board.

Celebration of our recapitalization, welcoming senior employees as shareholders.

The Last Decade, 2000-2006

During the early 2000’s, the Waterfield expanded operations further to the West and Northwest, opening new offices in Oregon, California and Chicago. In 2001, we developed and implemented the technology that created a paperless environment for delivery of loan documents. Waterfield also began a relationship with a very special organization – Habitat for Humanity – led by Lynn Weaver, EVP. We built ten houses within five years in our headquarters city of Fort Wayne, IN. In 2003, we celebrated our 75th anniversary and in honor of that milestone, Waterfield employees built one Habitat house in only 75 hours.

Ft. Wayne HQ employees gathered for Anniversary celebration (2003)

Also in 2003, Waterfield set an all-time company record with $11.2 billion in mortgages for the year. By mid-year 2004 Waterfield employed over 1,300 people in Fort Wayne and 2,600 nationwide. Our mortgage servicing portfolio reached $21 billion, consisting of approximately 175,000 loans.

By 2005 it became apparent that pressures were building to meet some shareholders’ needs and their expectations for liquidity. Further, the board wrestled with the issue of whether or not a mid-sized privately held mortgage banker could survive ever increasing competition from very large publicly held competitors, given their increasing aggressiveness and lower cost of capital. As a result, the board made the difficult decision to sell all entities in the Waterfield Group. In January of 2006 the sale of the mortgage origination subsidiary to American Home Mortgage Co. of Melville, NY was announced. The sale included 46 retail, wholesale and correspondent mortgage loan production branches in 16 states. In October of 2006, Sky Financial Group of Bowling Green, OH acquired the stock of Waterfield Mortgage Company and Union Federal Bank. (Shortly thereafter, Sky announced its own sale to Huntington Bank of Columbus, OH.)

After the Sale

I moved on to found Waterfield Capital, LLC, a Fort Wayne, IN based investment management company. I will forever be grateful to have been a witness to the dedication of so many people who gave their careers to Waterfield. We all worked hard and played hard, as the saying goes, and established many relationships that are lasting lifetimes.

I think many communities are better places because of our companies’ influence, and I hope most employees remember their “Waterfield days” as a very special experience.

Many executives of Waterfield have moved on to help lead other mortgage companies around the country. In this way, the culture of “The Waterfield Way” lives on.

Following the sale of Waterfield, a scholarship fund was established to benefit students majoring in finance at Indiana University-Purdue University Fort Wayne (IPFW). Known as the Waterfield Mortgage Career Employees Scholarship (SCORE+), its purpose is to honor those long term employees of Waterfield who gave their careers to the company. Annual grants in their honor are made to deserving students every year.

In 1992, the Waterfield family had founded The Waterfield Foundation, with our founder’s widow and children as directors. The purpose of the foundation has been to make grants primarily to education, the disadvantaged, and the fine arts primarily in the northeastern Indiana area. Becky Teagarden, formerly SVP of Human Resources for Waterfield, is the Executive Director of The Waterfield Foundation. (See homepage for link.)

The Early Years

Waterfield Capital, LLC